PRESS RELEASE

December 4, 2024

Manila, Philippines – During the CSOs Unite to Uphold People’s Rights, a gathering of civil society organizations (CSOs), the National Union of Peoples’ Lawyers (NUPL) presented the initial findings of its joint study with the Council for People’s Development and Governance (CPDG), “Playbook of Repression: Civil Society Report on the Misuse and Abuse of Countering Terrorism Financing Measures in the Philippines.”*

Based on a survey and focus group discussions with CSOs all over the Philippines, the study highlights how the government’s overzealous compliance with the Financial Action Task Force’s (FATF) Recommendations has severely impacted civic space and fundamental freedoms.

“The Financial Action Task Force (FATF) framework has been weaponized to suppress civil society,” said Atty. Josalee S. Deinla, Secretary General of NUPL. “This is not about genuine financial integrity but a facade of ‘paper compliance’ to meet quotas and exit the FATF Grey List. In the name of complying with FATF standards, the Philippine government is going after the wrong targets: it is our CSOs, human rights defenders, development workers, and grassroots communities who bear the brunt of this repression.”

Key findings

Arbitrary targeted financial sanctions

The broad and imprecise definitions of terrorism and terrorism financing have allowed assets of red-tagged CSOs to be arbitrarily classified as “related accounts” involved in financing terrorism. This has led to financial inquiries, ex parte asset freezes, and preservation orders targeting not only CSOs but also the personal accounts of their staff, officers, and even small business owners who are falsely accused of dealings with the NPA.

Disproportionate regulatory framework

The regulatory approach to the NPO sector in the Philippines has devolved into a mechanism of attack on civil society. Burdensome accreditation requirements, restrictions on foreign funding, and heightened surveillance have exposed CSOs to harassment and outright violence, disrupting their operations and isolating them from communities they serve.

Lack of risk-based approach

Targeted financial sanctions and criminal charges against CSOs lack a risk-based foundation, with only 0.05% of suspicious transaction reports involving NPOs from 2017 to 2020. Despite minimal assessed risk, the government imposes sweeping measures on the entire NPO sector, with limited consultation and no recent risk assessments, in violation of the FATF’s own standards.

Obstacles to financial access

The enforcement of FATF Recommendations on beneficial ownership and customer due diligence has hindered CSOs’ access to financial services. Banks, citing unsubstantiated risks, have frozen “related accounts,” and imposed burdensome compliance requirements, leaving CSOs unable to deliver critical services or meet operational needs.

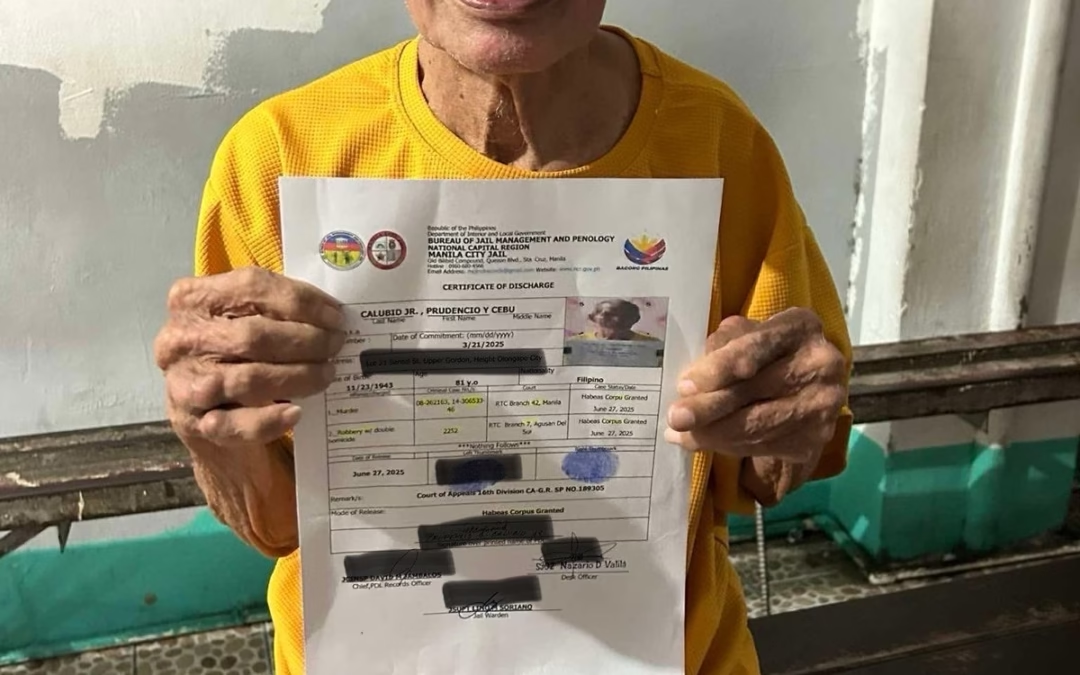

Fabricated criminal cases

The government’s focus on “paper compliance” to exit the FATF Grey List has driven a sharp rise in terrorism financing cases against CSOs and individuals, with a staggering 371% increase from 2023 to 2024. Many cases rely on perjured or coerced testimonies from professional witnesses, military assets, or “rebel returnees.”

Erosion of due process

The ATA and TFPSA empower the AMLC to freeze assets and conduct inquiries ex parte, depriving individuals and CSOs of meaningful recourse. Procedural safeguards are inadequate, with vague definitions and non-disclosure of evidence routinely invoked for national security, undermining the constitutional right to due process.

The report also reveals how Recommendation 8, designed to combat terrorism financing abuse of “high-risk NPOs” has been applied indiscriminately to the entire sector, disregarding disregards FATF’s own standards for proportionality and risk-based measures.

The report also criticizes FATF for enabling such abuses. “FATF’s lack of accountability and transparency allows repressive regimes like ours to weaponize its framework, transforming soft law into tools of political repression,” Deinla said. “What’s worse, FATF has failed to hold governments accountable for these abuses or demand action against financial crimes that matter, like corruption and money laundering.”

Deinla also observed that while CSOs are suffocated by stringent regulations, systemic corruption, including bribery involving Philippine Offshore Gaming Operators (POGOs) and misuse of confidential government funds, remains unaddressed. “The FATF’s focus on compliance metrics, like freezing accounts and prosecutions, completely misses the point when corruption thrives unchecked,” Deinla noted.

Deinla ended with a call to action: “Together we must resist this repression and demand our rightful place in civic space to pursue our advocacies for the people’s economic, social and cultural rights.” ###

Reference:

Atty. Josalee S. Deinla

NUPL Secretary General

+639174316396

*Copy available upon request.